Settebello’s Success Story: The Perfect Pizza Starts with Ben Furney Flour Mills

September 28, 2023September 2023 Seasonal Wheat Outlook

Welcome to the Spring Seasonal update for Ben Furney Flour Mills. To think that this time last year we were seeing cool conditions and constant rain across the eastern seaboard, and this year our inland area is warming up quickly and starting to become very dry.

Climate Outlook

On 19th September 2023, Bureau of Meteorology declared an El Niño. This declaration reinforces the long-range prediction of warmer and drier conditions for much of Australia over the next three months.

The current run of hot and dry weather is bringing home wheat, canola, and pulse crops in New South Wales at a rapid pace, with harvest in northern and central districts expected to start late October, 3 -4 weeks ahead of schedule.

How This Impacts The Wheat Crop

We are now entering the most critical month for wheat crops in terms of yield & quality. Flowering and then filling of the grain occurs, as it takes nutrients and moisture from the stalk and leaves and transfers them to the kernel. Recent daytime temperatures above 30 degrees Celsius, with westerly winds to boot, have visibly stressed some crops during this filling stage and has downgraded yield forecasts.

Wheat plants are influenced by factors like moisture and heat, planting time, and overall soil health. If there’s plenty of moisture when the wheat is planted, it will put out multiple tillers (additional stems from the main plant). In a normal year, this is a great sign of a healthy thriving plant.

At any point in the growing cycle if the plant doesn’t have enough moisture to “fill out” the tillers that it started the plant will “abort” tillers. Farmers call them “blanks” – empty husks which the plant started but couldn’t fill with kernels.

Blanks mean fewer kernels are harvested per hectare, degrading yields which results in less grain to sell.

One of the side effects is that with fewer kernels to support, plants pump more protein into the kernels that are formed and we see protein levels jump.

What Is The Crop Yield Forecast

Given the lack of rainfall across most eastern cropping regions, these regions are continuing to see declines in soil moisture reserves. This represents an increased risk of further reductions in crop yields if follow-up rainfall is not received in the next few weeks, which, at the moment, does not seem likely.

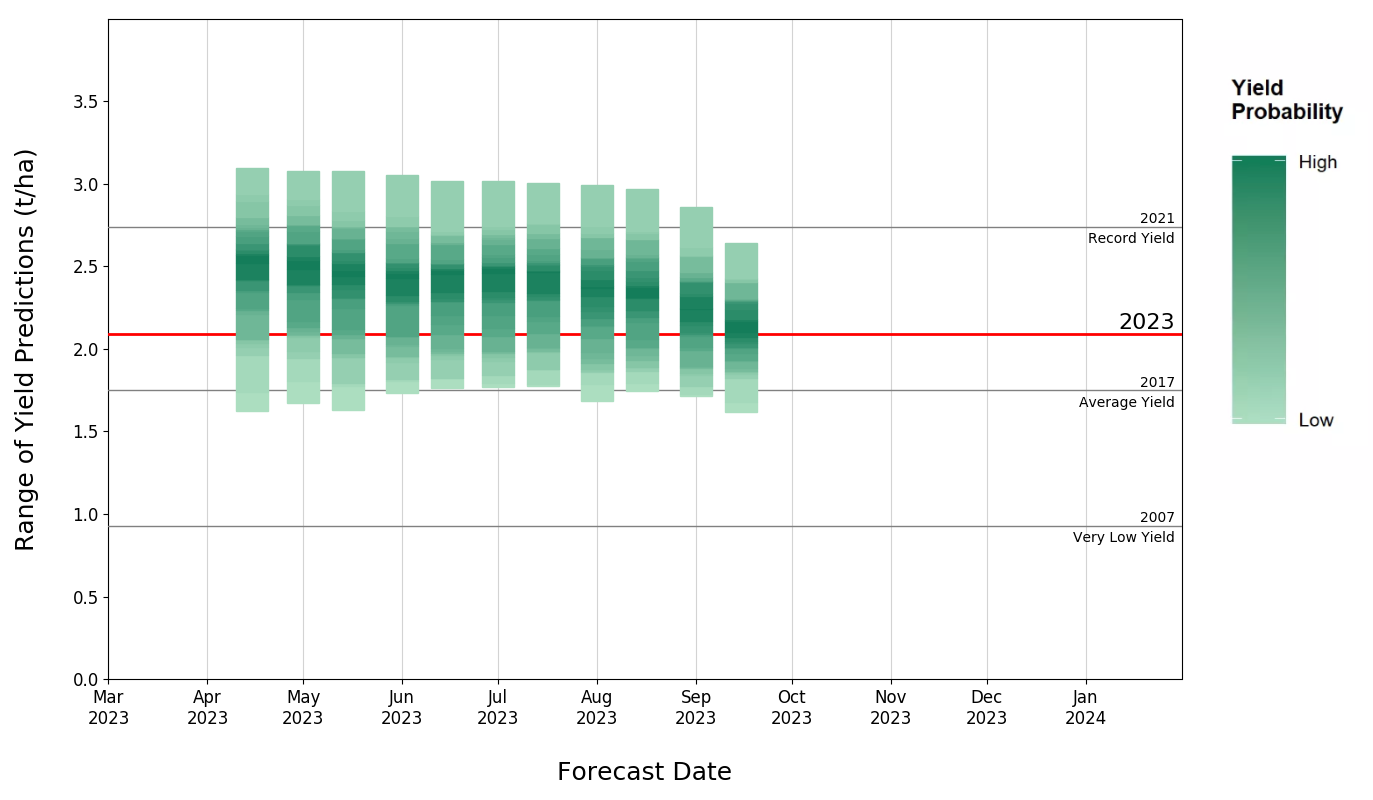

The red line shows the expected median value for this year’s yield at the latest fortnight’s forecast, but this will be a moving target in line with upcoming weather.

In our local area we are looking at an average to below average yield.

Wheatcast™: wheat yield forecasts for Australia – Digiscape Future Science Platform (csiro.au)

Each green band shows the Australia wide wheat yield forecast at the fortnight indicated on the horizontal axis. They show the whole range of possible outcomes with the most probable indicated by the darkest green shading.

What This Means For Australian Wheat Production

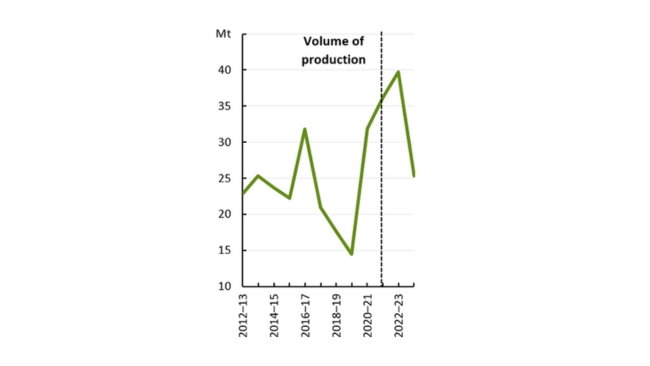

Official government forecaster ABARES expects Australian wheat production to fall by 36% to 25.4 million tonnes in 2023–24. This is only just below the 10-year average to 2022–23 of 26.4 million tonnes.

Annual gross volume of Australian wheat production

Note: Data to the right of the dotted line indicate estimates and forecasts.

Source: ABARES; ABS

To Put This Into Perspective

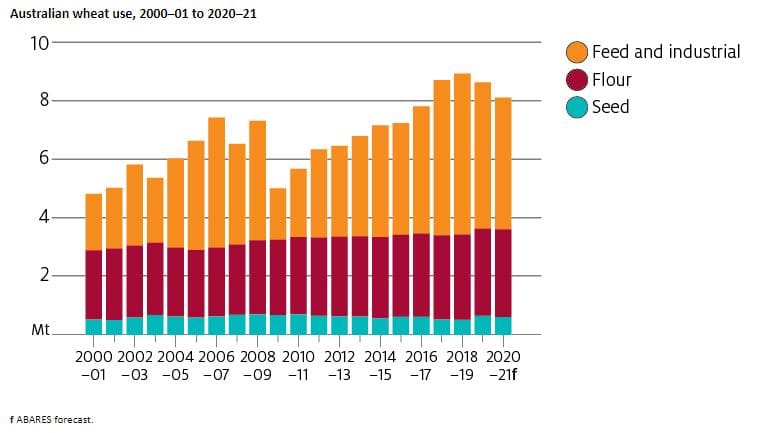

- Australian domestic consumption of wheat is about 8.4Mt per year, relatively small in comparison to total exports,

- Domestic wheat use comprises milling wheat for flour, livestock feed (direct to end users or stockfeed manufacturers), wheat for industrial use and for use as seed (seed retained to sow crops).

- Milling wheat for flour usually accounts for around 35pc of total domestic use at an average of around 3Mt.

Source: Grain Central

What this means going forward

While there will be a reduction in the quantity of grain produced this year, the warmer drier finish to the season generally means good high protein wheat will be harvested.

We are already identifying key areas where there are still good crops so that we can continue to source sufficient quality grain to meet the demands of our many customers. Whilst we are still a long way from having the wheat in storage there should still be plenty of grain available.